GSTIN Offline Check – AdarshGSTINCheck

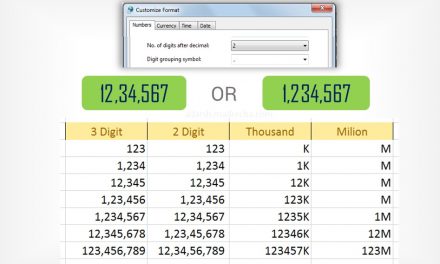

A simple and easy to use Excel Utility to identify whether GSTIN is correct

Amidst all the buzz surrounding GST, here comes another offering from Madrecha Group – ‘GSTIN Offline Check’.

GSTIN Offline Validation Tool

Number of Downloads

As on 29 Sept 2017

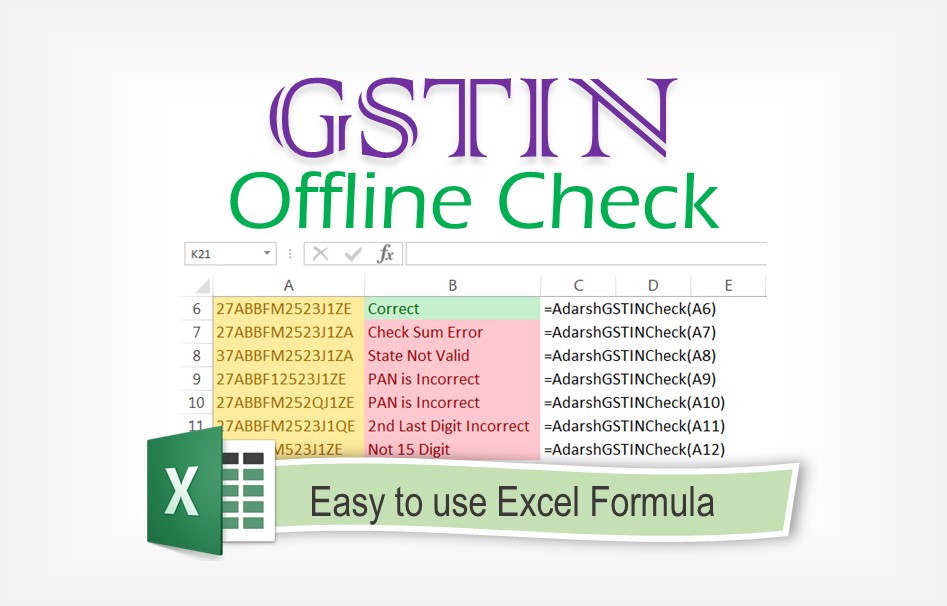

Using the tool is super easy. It is just an Excel Formula. Copy paste your data in excel file (Download Link Above) & use the formula = AdarshGSTINCheck(A1). That’s it.

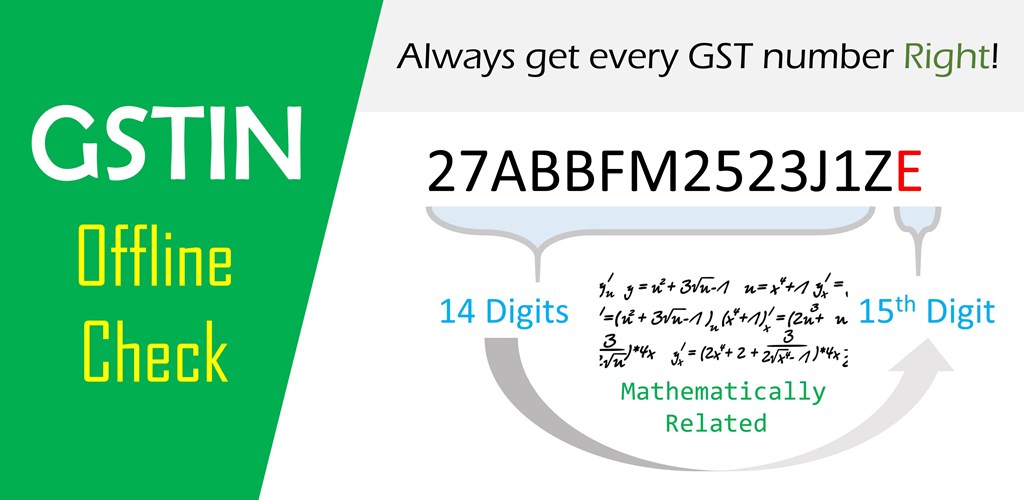

The Most important Validation provided by GSTIN Offline Validation Tool is “Check Sum” Validation. This is the heart of this Tool. The geniuses of the tool lie in the fact that first 14 digits of GSTIN are mathematically related to the last digit. Hence we can check offline whether the GSTIN number is correct or not.

This Mathematical relation was closely guarded secret until recently. To know more about how this works, watch the video below.

Apart from the positional validations (mentioned below) and Check Sum Validation mentioned Above, GSTIN Offline Check also provides following validations

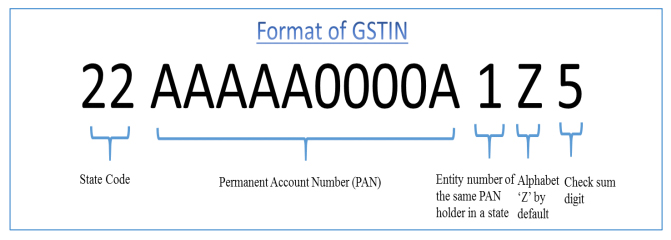

- Length of the Number should be 15 Digits

- State Code should be between 01 to 37 or 98

Following is the list of Positional Validations performed by =AdarshGSTINCheck() Formula

- First 2 (1st, 2nd) Characters Should be Number

- Next 5 (3,4,5,6,7th) Characters should be Letter

- Next 4 (8,9,10,11th) Characters should be Number

- Next 1 (12th) Character should be Letter

- Next 1 (13th) Character can be Number or Letter

- Next 1 (14th) Character should be “Z”

- Next 1 (15th) Character can be either a Number or a Letter

Purpose of this GSTIN validation Tool / Utility

For Tax Consultants / CA Firm

To file GST return, we upload the CSV files / Excel file to GSTN Portal. We need to then wait for approx 20 mins for the portal to generate the error file. Once error file is generated, we need to download the zip file and load it into the GST Offline Utility. This entire process is very time consuming and can hamper the productivity of the user filing GST returns. Myself, being a Chartered Accountant, I developed this tool primarily for the benefit of the fraternity.

For Businesses

Businesses who will generate data for GST return filing, need to make sure the data is accurate before sharing it with their GST Consultants / CA. This utility will provide them with a degree of assurance that the GSTIN numbers are accurate. This will reduce back and forth between the businessmen and their CA. Thus, saving time for businessmen as well as tax consultnats.

For Software Vendors

If you are a software vendor and looking to implement this in your software, feel free to contact me. We can easily incorporate this into your software. I already have .net and java code available.

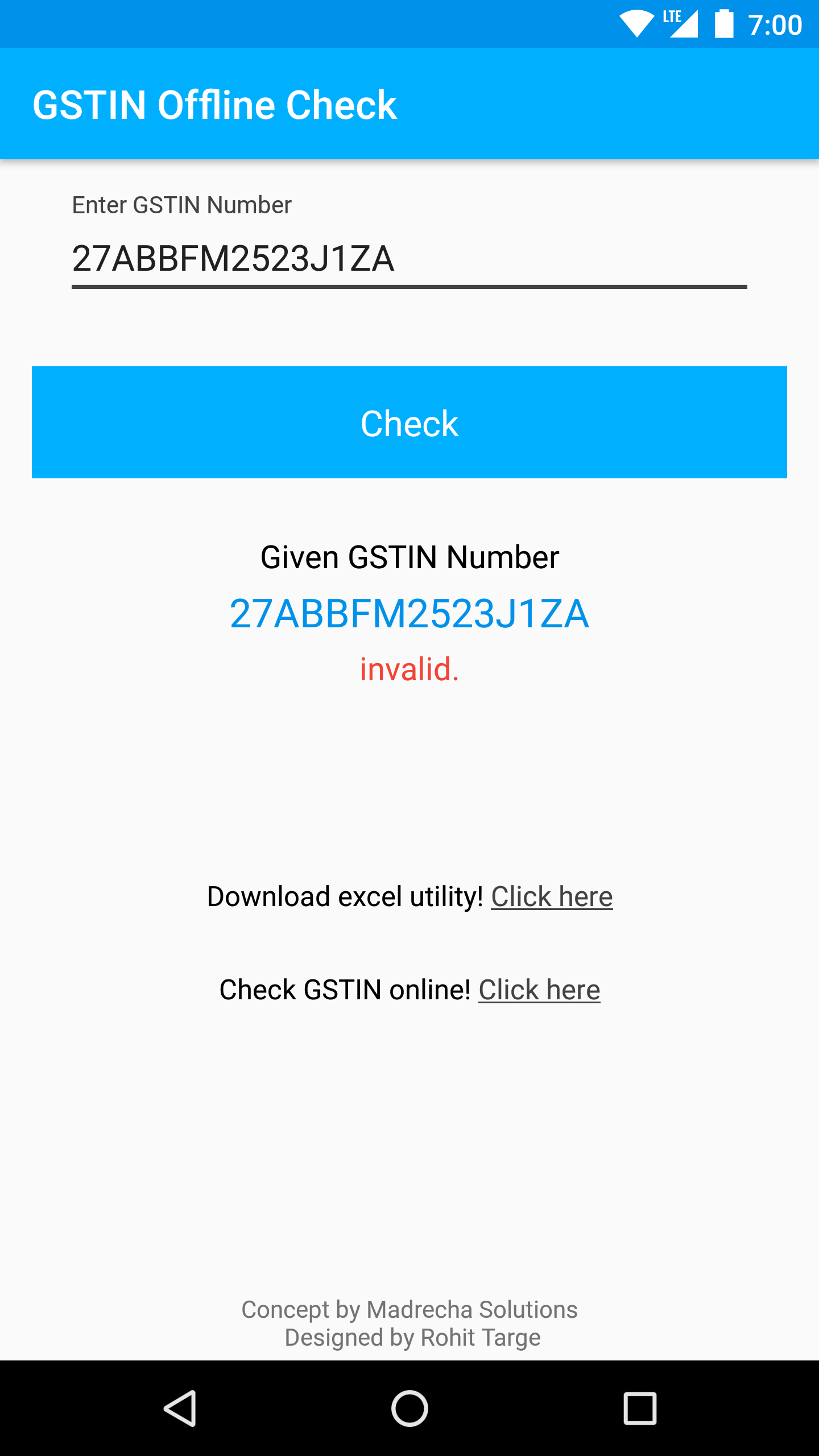

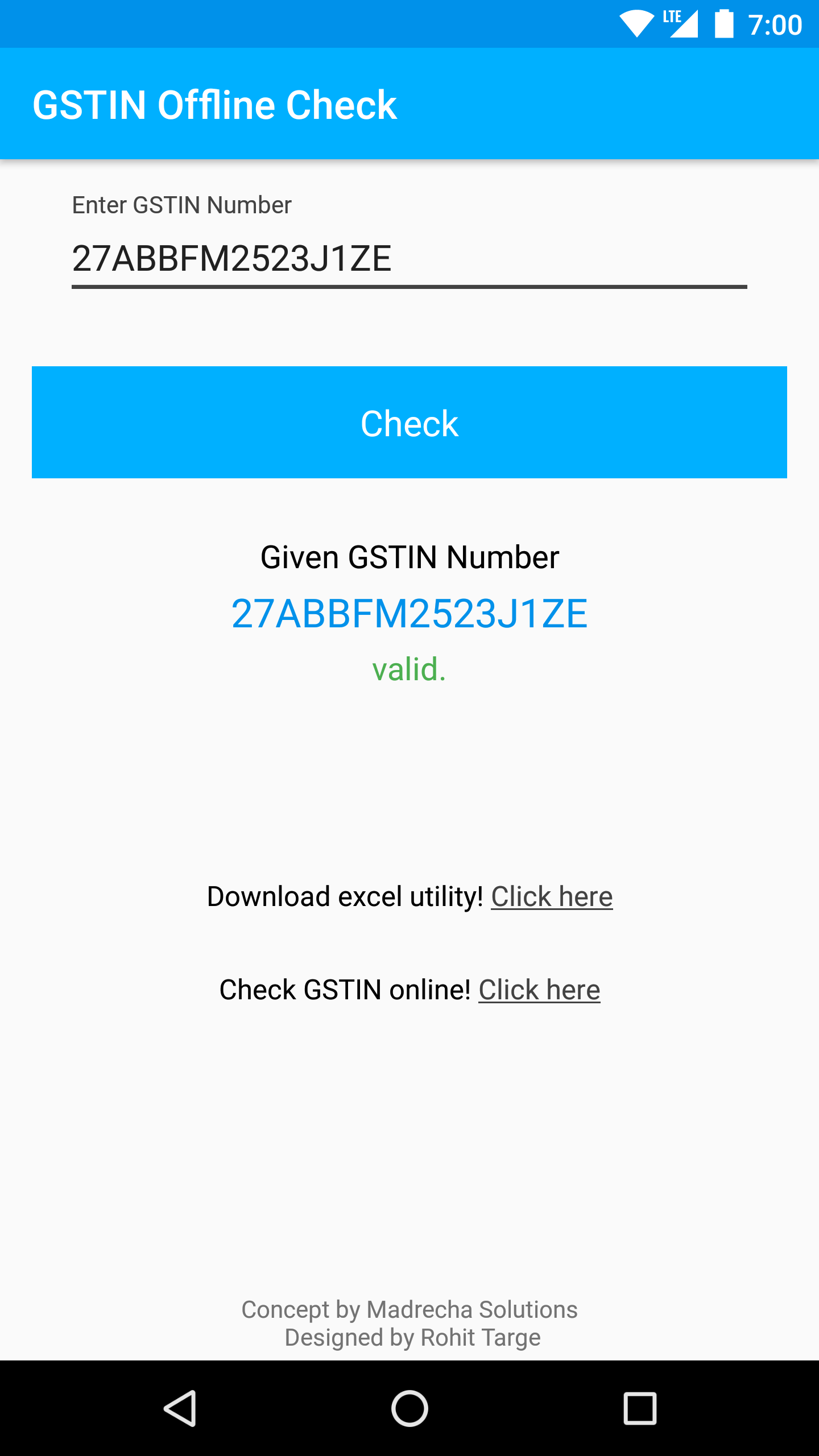

Androd App to check GSTIN

For Businessmen on the move

Not every businessman may have a PC handy every time he needs to check GSTIN. Also, many times, having access to the internet is not a guarantee. Hence, we also launched an android app for checking GSTIN. Go to Play Store and search for “GSTIN Offline Check”. The app is listed as from “Madrecha Solutions”. Special thanks goes to Rohit Targe for designing and developing the app. Few of the screenshots of the app are shown below.

The focus of development was to have a super easy app to check GSTIN.

Search for “GSTIN Offline Check” on play store.

Learn How to calculate GSTIN Check Sum Value

Version History of Excel GSTIN Validation Tool

v1.2 - 02 Aug 2017

Fixed a bug where GSTIN starting with 36,37 was shown incorrectly as Error.

v1.1 - 02 Aug 2017

A public launch of the Tool.

- Fixed Some Bugs.

- Error Description is more meaningful. Thanks to CA Priya Madrecha.

v1.0 - 01 Aug 2017

Initial Version. Shared Internally for testing.

v0.1 - 31 July 2017

Concept Release

Thanks to Harsh Mehta & Shweccha Jain

It is simply amazing. My office efficiency will definitely increase because of this GSTIN Offline tool

Thanks a Ton. I was looking for this Utility since July

Yes, It is indeed a very useful tool. I have shared it with my clients too. This will ensure I get error free GSTIN data.

Thanks Adarsh.

Great work adarsh ji such a helpful tool it is

Thank you for creating this

Thank you for sharing!

Hi

Why don’t you develop it as excel add in instead of an xlsm file so that the formula may be used in any excel sheet that is open. Secondly, what is the multiplication factor that you are talking about in your youtube video on GSTIN checksum?

If you are interested in developing as an AddIn, email me on adarsh@madrecha.com

WILL YOU PLEASE EXPLAIN CHECK SUM VIDEO WITH ONE OR TWO EXAMPLES.I WILL BE VERY GRATEFUL TO YOU.

Sir 98 State Code is either State

I am a software developer & develop software in vb6. can you have any sample code for verify gstin in vb 6

Thanks for sharing.

The tool can be better if it can also validate the 4th Character of a PAN number.

The fourth character in a PAN has to be one of the following ten characters:

A B C F G H J L P T

The fourth character represents the status of the PAN holder. C stands for Company, P for Person, H for HUF (Hindu Undivided Family), F for Firm, A for Association of Persons (AOP), T for AOP (Trust), B for Body of Individuals (BOI), L for Local Authority, J for Artificial Juridical Person and G for Government.

Sir if suppose I need record/details when user enters the gst number than how should I do or if you can provide me the code that will be good