SAP Procure to Pay (P2P) Accounting and How to Audit

Introduction

Accounting In SAPIn SAP Procure to Pay (P2P), we create 4 documents to complete the entire process of procuring the goods to payment to the vendor.

- Purchase Order (PO)

- Goods Receipt (GRN)

- Invoice (Invoicing)

- Payment

In some cases, there can be Purchase Requisition, before Purchase Order.

There is no accounting entry for creation of Purchase Order, accounting entries start from posting of GRN. Let’s see in a general scenario which accounting entries are created in SAP.

Let’s Take an example, we have a PO for 50Kg Price as 520/kg. Thus PO amount – 26,000

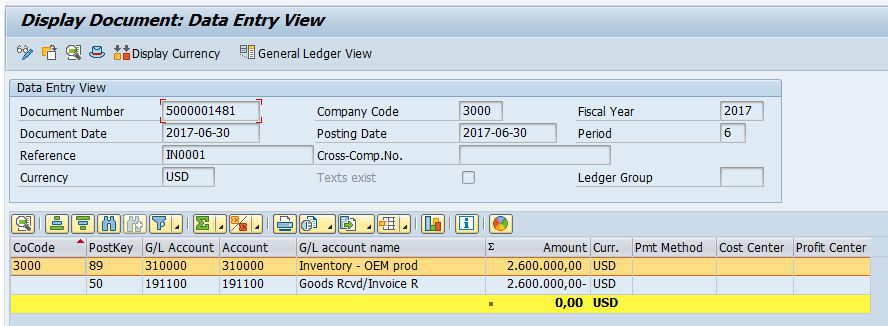

At the time of GRN Accounting Entry will be

Raw Material a/c Dr – (GRN Qty X PO Price) [310000]

To GR-IR a/c [191100]

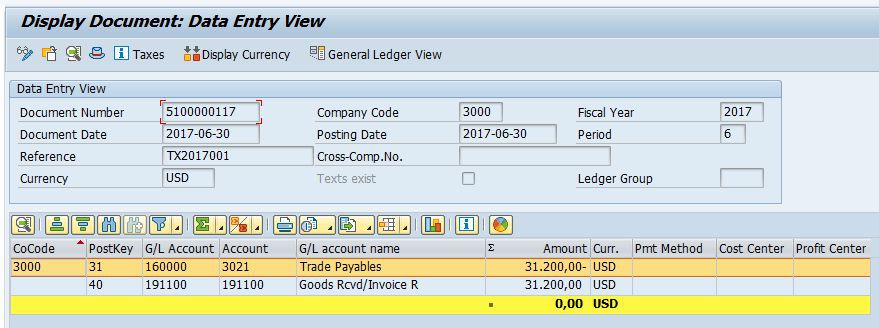

At the time of Invoice Accounting Entry will be

GR-IR a/c Dr – (Invoice Qty X Invoice Price) [191100]

To Vendor a/c [16000]

At the time of Payment to Vendor Accounting Entry will be

Vendor a/c Dr – (Invoice Qty X Invoice Price)

To Bank a/c

In this Article we will only focus accounting entries at the time of GRN and Invocing.

Account Determination

Accounting ConfigurationThe Accounting entries which we saw in above section is governed by account determination configuration. Users while creating documents like GRN, Invoicing should not be confused / bothered for GL Account to be selected. Hence GL Accounts are automatically selected based on configuration and accounting entry is posted. Now let’s see how each of the accounts is selected.

Raw Material Account Determination at the time of GRN (i.e. Dr)

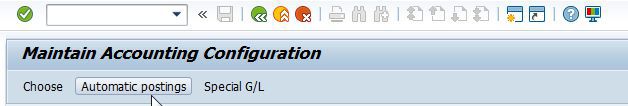

Go to TCode FBKP and Click on “Automatic Posting”

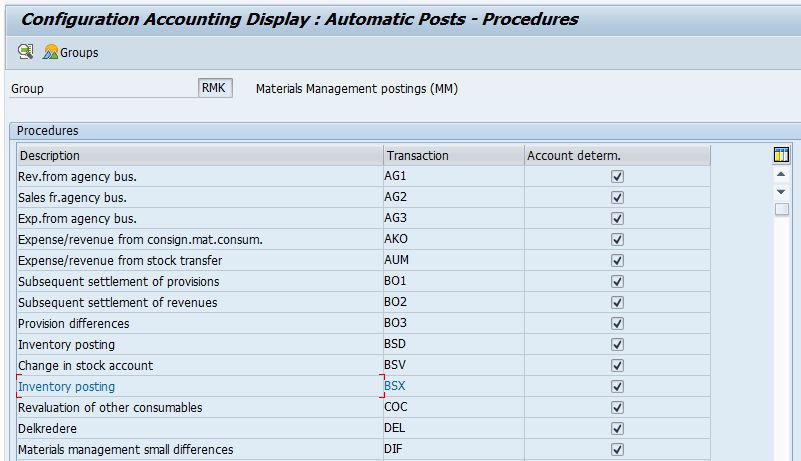

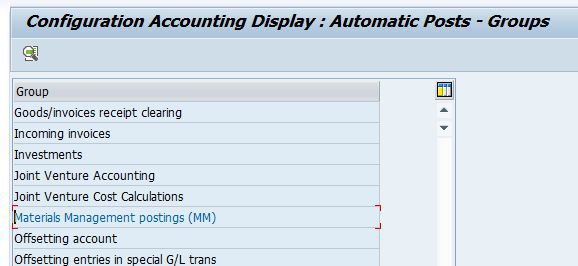

Search for “Material Management Posting (MM)” and Double Click

Now we need to select Transaction. The transaction we are interested is “BSX” aka “Inventory Posting”. Double Click “Inventory Posting”.

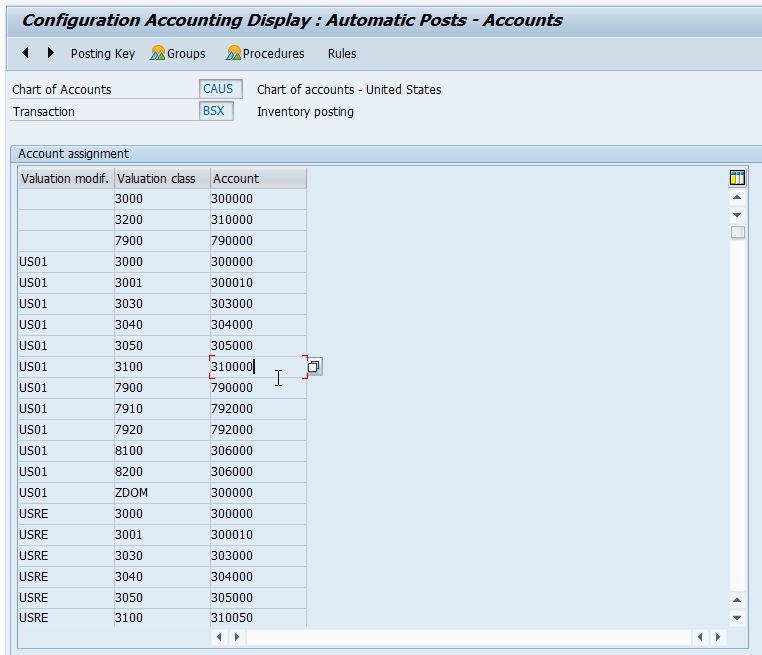

Here we define GL Account which will be hit at the time of Inventory. This setting is defined at “Chart of Accounts”. Hence when you click on “Inventory posting” in the previous screenshot, SAP will ask for Chart of Accounts (COA). In our example, the COA is “CAUS”.

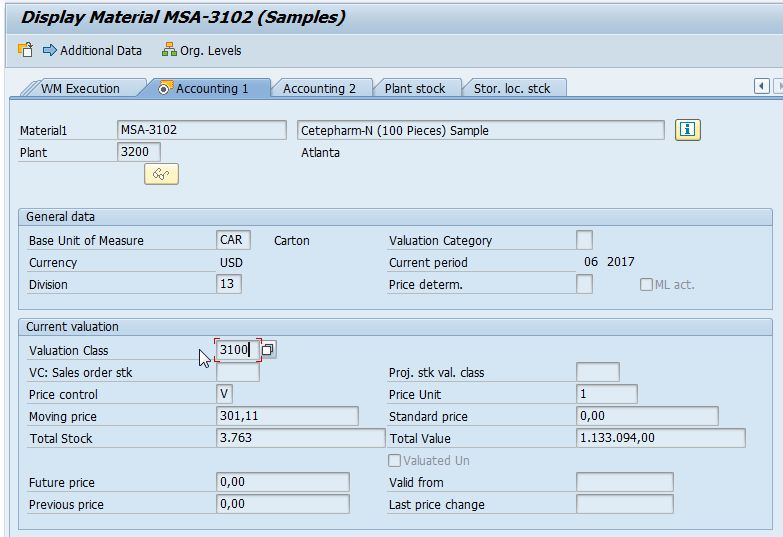

As you can observe, we can define GL Account for each Valuation Class and Valuation Modifier (also called as valuation grouping code). Thus in our case, we know that GL account was 310000, now let’s check Material Master if the Valuation Class is correctly defined.

To minimise the necessary effort involved, valuation areas with the same account number assignment can be grouped together. This is done through the valuation grouping code (aka Valuation Modifier). The valuation grouping code is then used to assign the G/L account numbers. The valuation grouping code (dependent on the valuation area) helps you to configure automatic account determination with the minimum possible effort.

Open Material Master in View Mode using TCode MM03. You can observe that Valuation Class is set as “3100”. You need to go to “Accounting 1” Tab of Material Master to View Valuation Class. Since Valuation Class is defined for each Plant, you will need to enter plan number to open “Accounting 1” Tab. In our example, plant code is 3200.

GR-IR Account Determination at the time of GRN (i.e. Dr) and Invocing (i.e. Cr)

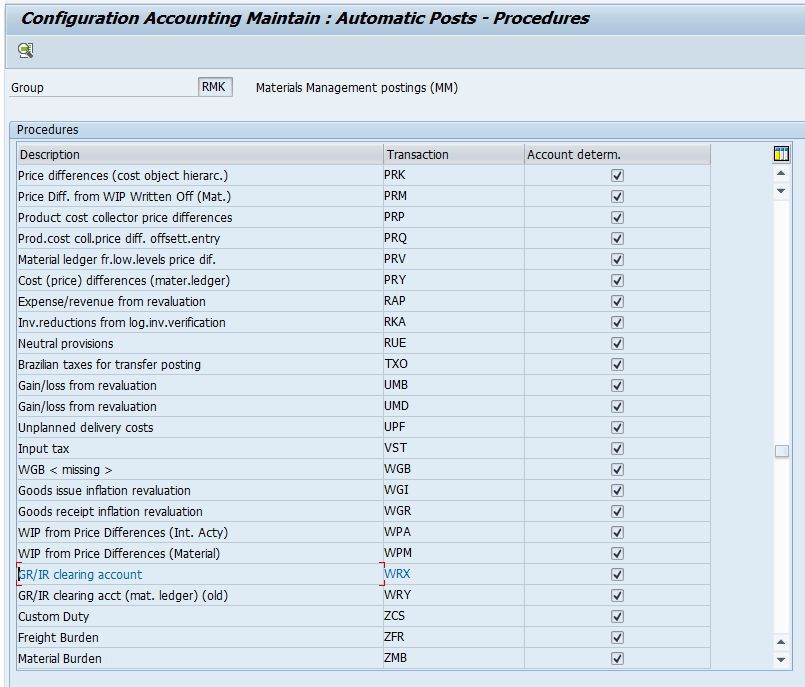

Open TCode OBYC. This will get us a list of transactions for which we need to configure GL Accounts. As you can see in the screenshot, we are on “RMK” Group. Thus we are seeing the list of transactions for P2P Cycle.

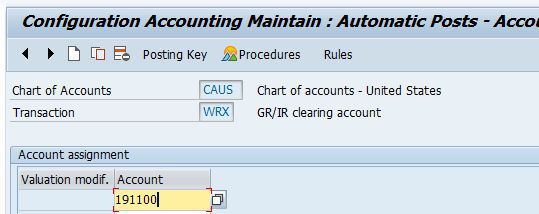

Double click on “GR-IR Clearing Account” (i.e. WRK) Transaction.

When you double click on “WRK” transaction, you will be asked for Chart of Accounts (COA). In our example, COA is “CAUS”. The GL Account can also be defined for “Valuation Modifier” as explained above.

As you may have noticed we have not defined whether the GL account is to be Debited or Credited. SAP will automatically dtermine whether account is Debited or Credited.

Vendor Account Determination at the time of Invocing (i.e. Cr)

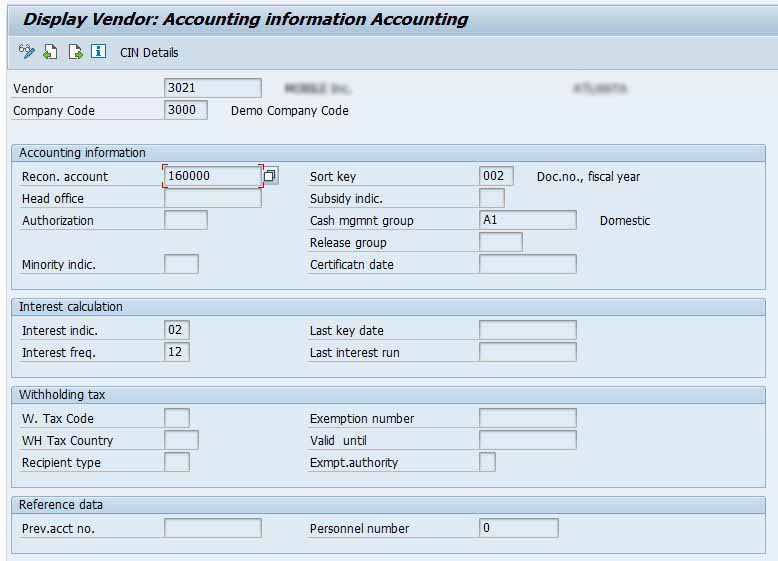

GL Account determination for Vendor is simple and straight forward. Open XK03 which will ask for Vendor Code.In our example, Vendor Code is 3021. In the “Accounting Info” Tab we can see that Recon Account is defined as 160000.

Extracting Configuration

How to conduct system auditVendor GL Determination – Extraction

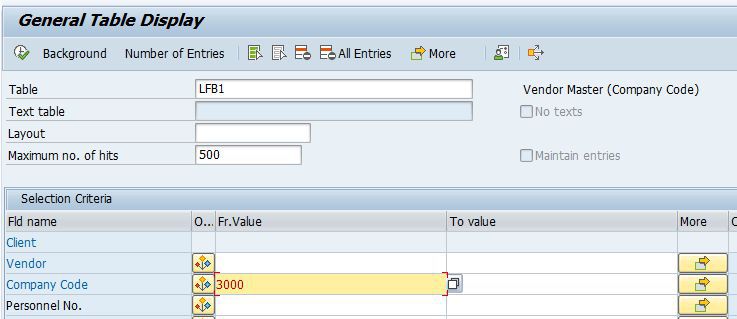

Recon Account of Vendor is saved in Table – LFB1. Using SE16N you can easily extract recon accounts. Parameters which needs to be filtered – Company Code

GR-IR GL Determination – Extraction

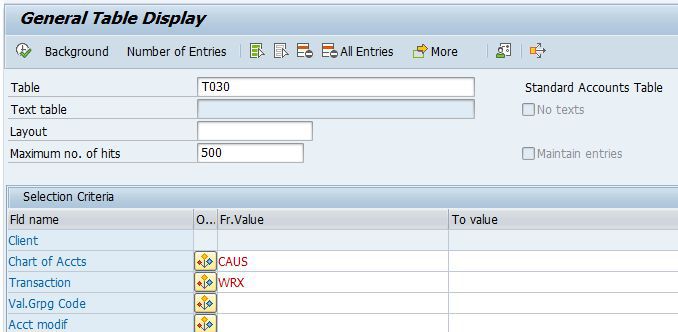

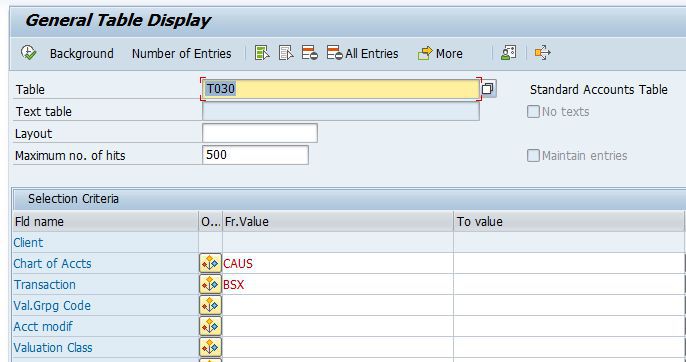

GR-IR account determination information is stored in T030 Table. Go to SE16N and extract this using following parameter – Chart of Accounts (COA) and Transaction “WRX”

Inventory GL Account Determination – Extraction

Inventory account determination information is stored in T030 Table. Go to SE16N and extract this using parameter – Chart of Accounts (COA) and Transaction “BSX”

Thanks, great article.

Nice article! In depth coverage

Great insight. Looking for more such articles on Account Determination in future.

Good articles about P2P, thanks increase my knowledge